Rio Tinto chief tells forum he is optimistic about industry's future

Global oversupply of iron ore is expected to continue as China's crude steel output enters a stable period, according to the country's top economic planning agency, the National Development and Reform Commission.

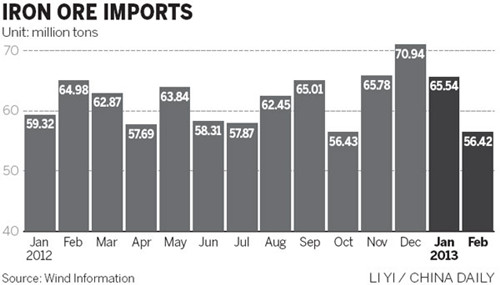

It released figures on Monday showing that China is expected to produce 746 million metric tons of crude steel in 2013, 30 million tons more than last year. This will result in new iron ore demand of 50 million tons.

"As China's steel industry shifts its focus to raising efficiency and improving quality, the country's crude steel output will remain stable or even slightly reduce," the commission said.

Globally, many developed economies have been suffering slower economic growth, which has had an effect on steel product demand.

Emerging economies such as India are seen as having limited scope for growth in steel consumption, the commission said.

But at the same time, new iron ore capacity is increasing globally.

China's domestic new iron ore capacity is expected to reach 20 million tons this year, according to the commission.

Figures show that the world's top three international iron ore producers - Vale Ltd, Rio Tinto PLC and BHP Billiton Ltd - are expected to have total new iron ore production capacity of around 100 million tons in 2013.

New iron ore mines in Australia's Karara area and Africa are being established or enlarged, and they will gradually start production in 2014 and 2015, which will add increased supply to the iron ore market.

However, most global players remain optimistic about China's future iron ore demand.

Sam Walsh, Rio Tinto's chief executive officer, said that China's continuous urbanization and industrialization processes will continue to bring growing demand for iron ore from his company.

Walsh joined other top global leaders at the China Development Forum, being held in Beijing by the State Council's Development Research Center, and hosted by Vice-Premier Zhang Gaoli.

Since taking charge of the global miner in February, predicting China's iron ore demand has been one of Walsh's biggest challenges, he said.

He said he believes that China's "enormous" base will create significant demand.

At present, a third of Rio Tinto's revenue is from the Chinese market, he added.

The company has spent $2 billion in China on equipment and supply purchases over the past year, and Walsh said Rio Tinto will keep investing in the market.

He said the company plans to offload under-performing non-core businesses and projects this year, and refocus on the businesses that add the most value.

He predicted that iron ore prices will fall to a reasonable level over the short term.

"In recent times, iron ore prices have been high as a result of a number of factors including seasonal issues, destocking of steel mills and strong steel production during the first couple of months," he said.

Earlier this month, Rio Tinto said it expected iron ore prices to drop 50 percent in 18 months, according to a report in the Herald Sun newspaper in Melbourne, Australia.

Another high-level representative from another giant iron ore producer, who declined to be named, also expected iron ore prices to drop, but that a 50 percent drop was too "dramatic".

He said China's iron ore demand had not reached its peak yet.

"The urbanization process and machinery manufacturing will be two growth points for China's steel and iron ore demand," he added.

Copyright ©1999-2011 Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.