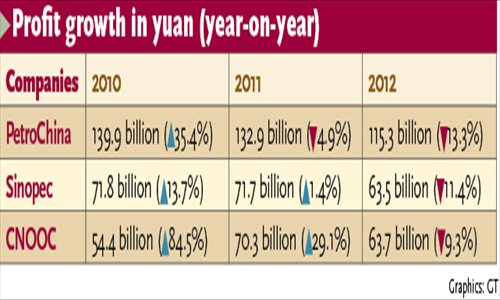

Sinopec Corp, China's largest oil refiner by output, said its net profit in 2012 dropped 11.4 percent year-on-year to 63.5 billion yuan ($10.22 billion) due to a major decline in prices of petrochemical products, according to a filing on the Shanghai Stock Exchange Monday.

The company's sales revenue increased 11.2 percent year-on-year in 2012 to 2.79 trillion yuan, it said.

China's three largest oil companies - Sinopec, PetroChina and China National Offshore Oil Corp (CNOOC) - all saw their net profits down in 2012.

The decline is a reflection of the slowing Chinese economy, as commodity prices and demand are closely related to the overall economy, Wang Jintao, chief analyst at commodity information provider Zibo Zhongyu Information Technology Co, told the Global Times Monday.

CNOOC saw its net profit drop 9.3 percent year-on-year to 63.7 billion yuan in 2012, and it said that rising costs in offshore exploration are the major reason behind the drop.

PetroChina reported net profit of 115.3 billion yuan in 2012, down 13.3 percent over 2011. The company blames last year's increase in natural gas imports for the decline in net profit, as well as the government's cap on domestic gasoline and natural gas prices.

At present China's National Development and Reform Commission (NDRC) adjusts domestic gasoline prices when international prices change more than 4 percent over 22 consecutive working days.

The pricing mechanism has long been accused of lagging behind international fluctuations and causing losses to the oil industry's refining sector, which relies heavily on oil imports.

A new gasoline pricing mechanism, which will shorten the adjustment span, may arrive along with the next price adjustment, said Wang.

"The new pricing mechanism, which is more market-oriented, will ease the cost burden of the refining sector," said Han Xiaoping, chief information officer of energy research portal china5e.com, who noted that the forthcoming reform of natural gas pricing is also good news for oil companies.

Despite declining profits, the three companies' spending on employee salaries have seen a major increase in 2012, which has been criticized by some experts.

CNOOC spent 2.53 billion yuan on employee salaries in 2012, surging 66 percent year-on-year. The other two oil giants also saw employee expenses up around 10 percent last year.

Experts said that the NDRC already took steps last year to make gasoline price adjustments in a timely manner, which helped to cut losses in the oil refining sector.

Copyright ©1999-2011 Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.