Japanese automakers are facing a bumpy road in the world's largest vehicle market as annual sales went into reverse gear amid tension over the Diaoyu Islands.

Regaining market share from foreign rivals who have overtaken them will be difficult, analysts said.

"If Sino-Japanese diplomatic relations improve, Japanese automakers might see a slight increase from last year in sales by the end of 2013," said Yale Zhang, head of Shanghai consulting firm Automotive Foresight.

"From a long-term perspective, they have a bleak future in the Chinese market as it's almost impossible for them to close in on the top three automakers here: Volkswagen, General Motors and Hyundai," said Zhang.

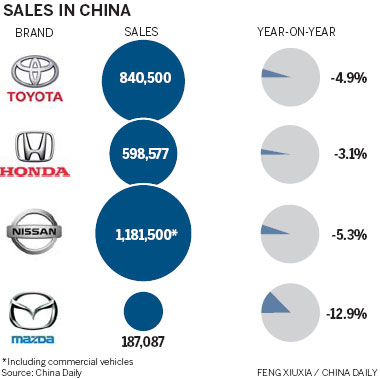

Toyota, Japan's largest automaker, said on Monday that its sales in China dropped 4.9 percent to about 840,000 vehicles in 2012 as sales in December fell for the sixth consecutive month to 90,800 vehicles.

However, it expected a recovery in 2013 with a sales target of more than 900,000 vehicles, similar to sales in 2011.

Top Japanese companies all experienced a crash in sales.

Nissan told China Daily that it sold 1,181,500 vehicles in China in 2012, down 5.3 percent for the year.

Its December sales of 90,400 vehicles helped weather a drop in sales of nearly 40 percent in September.

Nissan attributed the slump to tension over the islands that month.

Honda reported that its sales in 2012 fell 3.1 percent to 598,577 vehicles.

Mazda sold 187,087 vehicles in China in 2012, 12.9 percent lower than in 2011.

The company's China CEO Noriaki Yamada said that though sales fell in the second half of the year after steady growth in the first six months, he hoped new models and an expanded dealership network would win back customers.

Analysts said they are "not optimistic" about the future of Japanese brands in China.

"The outlook for Japanese manufacturers in China does not augur well, with IHS Automotive forecasts indicating an immediate drop in sales and production amid concerns that the situation may extend for a longer period than previously thought,'' said Namrita Chow, senior analyst of market specialists IHS Automotive.

According to their estimates, production and sales for Japanese automakers in China fell by 200,000 vehicles in 2012.

This represents about 20 percent of Japanese vehicle sales in China.

They also forecast that lost production is likely to hit 350,000 vehicles in 2013 and 300,000 in 2014.

Zhang, from Automotive Foresight, said that the aggressively expanding German, US and South Korean automakers are also eating into Japanese sales.

According to Zhang, Volkswagen, General Motors, Hyundai and Ford will add 1.6 million vehicles of production capacity in China in 2014, based on annual output in 2012.

And this will rise to 1.9 million in 2015, he said.

"The bad market performance in China, the world's biggest market, will soon have serious consequences on their global sales and profit," said Zhang.

Even before tension erupted, Japanese automakers had started to lose their competitive edge to foreign rivals.

Japanese vehicles have a well-established reputation for low fuel consumption, competitive prices and quality.

However, Volkswagen, General Motors and Hyundai are paying more attention to consumer demand in China.

Even before the Diaoyu Islands tension, Japanese models had been pushed out of the top-10 best-sellers' list in China in the first eight months of 2012. According to research firm J D Power in July, 35 percent of Chinese consumers wanted European cars, up from 25 percent in 2009. Consumers wanting Japanese cars fell to 24 percent from 32 percent in 2009.

Copyright ©1999-2011 Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.