Chinese group expected to take 90 percent stake in leasing arm

The largest Chinese acquisition ever in the US - a stake of up to 90 percent in the aircraft-leasing arm of American International Group Inc - is likely to be approved by both governments, according to experts.

A Chinese investor group led by New China Trust Co Ltd has signed an agreement with AIG to pay $4.23 billion for 80.1 percent of International Lease Finance Corp, the world's second-largest aircraft-leasing company by fleet. AIG, which wholly owns ILFC, announced on Sunday night that the Chinese investors have the option of acquiring an additional 9.9 percent stake.

The investor group, which also includes P3 Investments Ltd and China Aviation Industrial Fund, is expected to be expanded to included New China Life Insurance Co Ltd and an investment arm of ICBC International, according to the statement.

The transaction is expected to close during the second quarter of 2013, AIG said. The two sides are waiting for approval from both the US and Chinese governments.

"I am optimistic on the acquisition, although it involves the largest amount of Chinese investors in the US," said He Maochun, director of the Research Center for Economic Diplomacy Studies at Tsinghua University's Institute of International Studies.

The governments will not interrupt the acquisition in the aircraft-leasing business, an industry that does not affect national security, he said.

"Chinese overseas acquisitions are going smoothly overall, and fewer and fewer acquisitions were interrupted by the government," He added.

In normal market behavior, any acquisition is decided by the commercial benefits to both sides, He said.

Also, Chinese companies have to take the commercial risks after the acquisition is completed, he added.

It is not the only Chinese acquisition involving a huge price recently.

The Canadian government approved CNOOC Ltd's $15.1 billion bid for Nexen Inc, a Canadian energy company, on Friday. Once the acquisition is complete, it will be the largest overseas acquisition by a Chinese enterprise.

"It is necessary for Chinese companies to go international, as they are developing," said He. "The foreign companies' brands and market networks also lure Chinese businessmen."

ILFC owns or manages more than 1,000 aircraft and is committed to purchasing 229 new aircraft. ILFC also has a customer base of about 200 airlines in 80 countries.

The network and international experience of ILFC is attractive for Chinese leasing companies, which are new and lack professional knowledge in the international market, some business insiders said.

"Purchasing the stake in ILFC is good for Chinese leasing companies to enter the international market directly," said Zou Jianjun, a professor at the Civil Aviation Management Institute of China.

The strong domestic demand in China will support the aircraft-leasing business, while the global aviation industry is going down, Zou said.

"It is also reasonable move for Chinese leasing companies, which plan to expand their fleets through the acquisition," he said.

Boeing Co has forecast that China will need 5,260 new aircraft from 2012 to 2031, and the Aviation Industry Corp of China has also announced that China will have a need for 4,933 new aircraft in the next 20 years.

"For airlines, airplane manufactures and leasing companies, the China market is the world's fastest-growing," said Wang Yukui, Boeing China's vice president of communications.

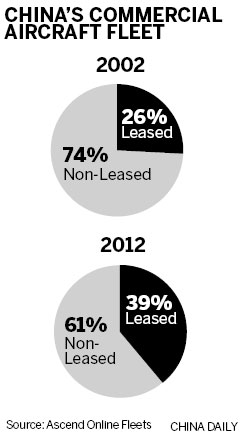

Chinese companies are also eyeing the aircraft-leasing business, with more than 20 domestic companies working in the sector currently.

Bank of China established its aviation arm through an acquisition in 2006, and BOC Aviation is now the largest aircraft leasing company in Asia by fleet.

China was already ILFC's biggest single market with over 200 aircraft on order, Reuters reported.

ILFC saw a $39 million operating profit in the third quarter of 2012, against a $1.3 billion loss during the same period in 2011, according to ILFC's finance report.

Under the new owners, ILFC will retain operational independence, AIG said.

"The transaction allows ILFC to continue to serve its worldwide partners in the aviation industry with world-class service while accelerating its growth in important markets," said Weng Xianding, chairman of New China Trust.

Copyright ©1999-2011 Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.