Signs show int'l capital may be making inroads into the region

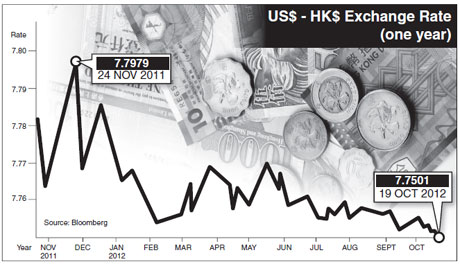

The Hong Kong dollar touched the HK$7.75 versus the US dollar level - the strong end of its permitted trading range - for the first time since December 2009, a sign that international capital may be kicking off their new inroads into the region, according to experts.

The Hong Kong dollar hovered around HK$7.75 and edged up to HK$7.7496 against the greenback on Friday. The Hong Kong currency is allowed to trade between 7.75 and 7.85 to the US dollar under the currency board system. And when it reaches the upper limit of its trading band, the Hong Kong Monetary Authority (HKMA), the city's de facto central bank, can be expected to intervene by injecting Hong Kong dollars into the market to keep its stability.

Radio Television Hong Kong cited anonymous traders as saying that the rally of the Hong Kong dollar is due to the continued inflows of capital into the city which betting on the future performance of the Hong Kong stocks and other assets.

It compared with the statement from Hong Kong Monetary Authority Chief Executive Norman Chan, who said last week that Hong Kong has not noticed any sizable net capital inflows and that the money inflows to the city is also expected to be at a smaller size over that in 2009.

Mark Wan, chief analyst from Hang Seng Bank Investment, said since the Federal Reserve unveiled a third round of quantitative easing (QE3) in September, emerging markets particularly those in Southeast Asia had noticed tremendous capital inflows, which had also pushed up the exchange rates of local regional currencies against the US dollar.

India's rupee has surged over 3 percent since the QE3 was announced, and the yuan has also similarly climbed, although to a lesser degree as the yuan is capped by the China Foreign Exchange Trading System, Wan told China Daily in a telephone interview.

The People's Bank of China has a yuan daily trading limit against the US dollar. In the foreign exchange spot market, Chinese banks can exchange the yuan 1 percent above or below the central parity against the US dollar announced by the China Foreign Exchange Trading System on each trading day. Prior to April this year, the daily trading limit was set at 0.5 percent.

Wan said that the worst time of the global economy may have passed and investment activities were invigorating again.

The city's benchmark Hang Seng Index registered a seventh straight weekly advance and Hong Kong home prices are at record levels. China's economic indicators including industrial production, retail sales and fixed-asset investment had all accelerated in September, signaling an improved economic environment both at home and abroad.

"With an influx of capital on the back of QE3 and an improving China outlook, it is now a live show testing the HKMA's loyalty and commitment to the peg," said Raymond Yeung, a Hong Kong-based economist at Australia & New Zealand Banking Group Ltd.

The Hong Kong dollar has been kept at about the HK$7.80 level versus the greenback since 1983. HKMA has said repeatedly it has no plan or intention to change the currency system given that it had continued to serve Hong Kong well over the years.

Copyright ©1999-2011 Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.