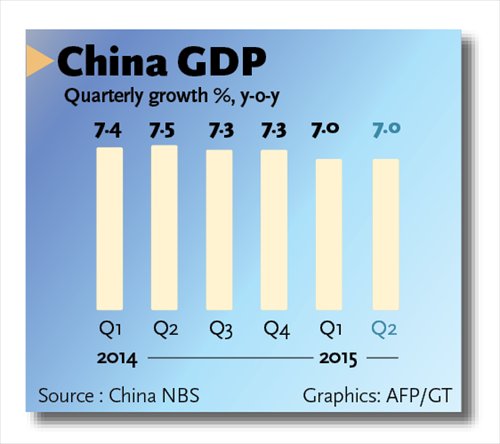

China posted a better-than-expected GDP growth of 7 percent in the first half of 2015, the result of pro-growth measures, a senior statistics official said Wednesday, denying speculation that the data had been inflated.

GDP growth stayed steady at 7 percent in the second quarter from a year earlier, unchanged from the first quarter, according to data from the National Bureau of Statistics (NBS). That surpassed forecasts of around 6.9 percent.

Sheng Laiyuan, an NBS spokesperson, told reporters Wednesday that the economy's improvement had been "hard-won," given the slow recovery in the global economy and huge downward domestic pressure.

"The better-than-expected economic performance was mainly due to the robust growth of the services industry, the recovery in home sales and stronger export growth," Xu Hongcai, an economist at the China Center for International Economic Exchanges, told the Global Times Wednesday.

"It proves pro-growth measures have worked, and China's economic structure is more balanced with consumption playing a bigger role in boosting growth," Xu said.

These measures included several cuts in both benchmark interest rates and banks' reserve requirement in the first half of the year, accelerated spending on infrastructure projects, and support policies to encourage mass entrepreneurship and innovation.

The stronger-than-expected GDP figures have raised speculation that China has inflated the data.

Last month, the Financial Times published an article which said falling prices in China helped mask a significantly worse economic slowdown than official figures suggest.

Sheng said different methods for calculating GDP adopted by China caused the misunderstanding.

"China's GDP figures were not overestimated, and they reflect actual conditions," he said.

Some market observers agree.

Today's data showing real GDP rising 7 percent from the same period last year is in line with Fitch's expectations, Andrew Colquhoun, head of Asia-Pacific Sovereigns at Fitch Ratings, said in an e-mailed statement to the Global Times Wednesday.

The resilience of retail sales in June is another encouraging sign that downside risk, while not negligible, is receding despite recent equity-market volatility, Colquhoun added.

Impact on stock markets

The better-than-expected GDP figures failed to buoy mainland stock markets, which slipped on Wednesday.

Sheng said a batch of government measures have had a positive effect on the bourses, and the government is capable and confident of preventing regional or systematic risks and ensuring the stable development of both the stock markets and the economy.

Analysts also played down the impact of the recent volatility in the stock markets.

The slump in the stock markets will have a limited negative impact on the future economic growth because authorities have already taken measures to prevent the risks from spreading to the financial system and economy, Zhang Jun, an analyst at Morgan Stanley Huaxin Securities, said in a note Wednesday.

Proactive policy

The economic performance in the first half of the year has reinforced official projections that China will achieve its annual growth target of 7.0 percent.

"We think economic growth in the second half of the year will most likely outperform the first half's, and we are confident that the annual growth target will be achieved," said Sheng, the NBS spokesperson, citing the implementation of investment projects approved in the first half of the year and China's improving real estate market.

Yan Yuejin, research director of E-house China R&D Institute, told the Global Times Wednesday that with falling inventories of unsold homes, investment in real estate is likely to speed up in succeeding quarters.

But some have warned that industrial overcapacity and sluggish external demand will continue to put pressure on the economy, which would prompt authorities to roll out more measures to stabilize the growth.

"China will need to continue implementing a proactive fiscal policy in order to lift investments in the second half of the year to meet the 15 percent growth target for fixed-assets investments this year," Liu Ligang, chief China economist at ANZ Banking Group, told the Global Times.

Given the slower growth of fiscal income in the first half of the year, the central government is more likely to accelerate private-public partnership projects to boost infrastructure investments, said Zhu Zhenxin, an analyst at Minsheng Securities.