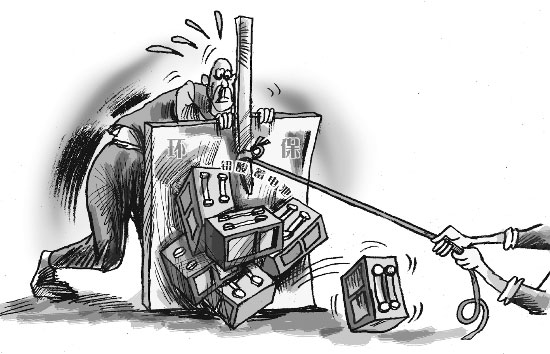

(Ecns.cn) -- Tough new entry standards for China's lead-acid battery industry came into effect this month. Analysts predict that the rules will cause a large number of manufacturers to close down, while also creating numerous opportunities for the recycling industry, according to China Economy and Information magazine.

Li Shengmao, of the CIC Industry Research Center, said there are currently about 2,000 lead-acid battery plants in China, and the regulation disqualifies nearly 90 percent of them. Meanwhile, the deadline to meet the new standards is little more than a year from now.

Jointly issued by the Ministry of Industry and Information Technology and the Ministry of Environmental Protection, the regulation requires the annual production capacity of an existing plant to be higher than 200,000 kilovolt-ampere-hours. Most of the country's lead-acid battery makers cannot reach that.

Moreover, the rules set more stringent standards for environmental and safety issues - issues that have long troubled the industry.

Angry citizens

Dating back to 1986, the Zhejiang Tianneng Battery Company is the largest automotive battery plant in China.

Now located at an industrial park in Changxing County of the southeastern province of Zhejiang, the company has developed rapidly in recent years, but its rise has not been free from controversy.

In June 2005, while the plant was located in the town of Meishan, more than 700 local children were diagnosed with slight lead poisoning. The mass illness was attributed to the Tianneng factory. 600 angry residents then broke into the battery plant and locked the staff inside before demanding that the company move its operations elsewhere.

A month passed and the company made no response, but on July 29, Tianneng's water supply system was destroyed and the incident finally came to a head.

The Changxing county government launched a two-month investigation into the battery plant and its surrounding environment, including the air, soil, underground water and ecosystem. It concluded that Tianneng's operation had not caused the lead contamination.

Nevertheless, Tianneng paid one million yuan (US$156,700) to local residents and relocated to an industrial park, where it remains to this day.

Questionable motives

After moving, Tianneng reportedly began increasing investment in environmental protection.

According to China Economy and Information, the company spent over 30 million yuan (US$4.7 million) on new equipment in 2005 and invested 50 million yuan (US$7.84 million) to make upgrades in 2006.

In 2009, Tianneng set up a recycling project for its battery production with an investment of 336 million yuan (US$52.7 million), putting it at the forefront of a wave of recycling in the industry.

Most Chinese battery makers cannot afford to get into the recycling business. Instead, they establish relationships with third-party companies that process byproducts such as lead dust, lead slime and lead powder. These small recyclers employ outdated technology, however, which makes them a major source of pollution.

As the largest automotive battery plant in the country, Tianneng may have the determination to improve its recycling ability, but it also faces many problems, and the recycling project may only be a publicity stunt to win support from the local government, said an industry watcher.

In China, lead-smelting technology is still underdeveloped, and so it is at Tianneng, he added.

According to China Economy and Information, the situation in developed countries is far different. In Switzerland, a recycler is paid the equivalent of 5,000 yuan for each ton of used batteries its processes, while in South Korea, battery makers must pay security deposits for production – money which is used for recycling.

Shape up or ship out

With the enforcement of the new standards, battery manufacturers in China are now being forced to improve or shut down. Some may have to seek acquisition.

Simply increasing production with new projects is not the best solution: The annual capacity of new lead-acid battery projects must now surpass 500,000 kilovolt-ampere-hours at a single plant, making such a decision cost ineffective.

Moreover, as the new regulations have higher recycling requirements, recyclers will have to update their technology and compete more aggressively.

Currently there are more than 300 companies engaged in the field of regenerated lead in China, but half of those operate without legal documents from the government. The regulation will force them change that.

According to China Economy and Information, the market value of regenerated lead in China will reach 36 billion yuan (US$5.6 billion) by 2015, with annual production rising as high as 2.5 million tons.

Copyright ©1999-2011 Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.