(Ecns.cn)--At a press conference on Monday, Hong Kong-based herbal tea maker Jiaduobao Group (JDB) focused on the launch of its new herbal beverage brand instead of responding to a threat on the same day by Guangzhou Pharmaceuticals Corporation (GPC), which said it would seek compensation from JDB for its inappropriate use of the Wong Lo Kat trademark.

GPC revealed that JDB has earned 7.5 billion yuan (US$1.18 billion) in profits through unauthorized sales of Wong Lo Kat brand herbal tea since 2010. "The compensation figure is calculated based on JDB's annual sales of over 18 billion yuan accruing from the brand," Ni Yidong, a spokesman for GPC, told the Global Times on Monday.

The statement came a day after JDB announced that it had filed an appeal with a Beijing court over an earlier ruling that revoked its right to use the brand.

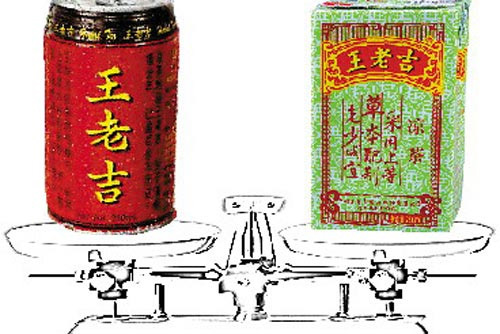

For a decade, JDB sold herbal tea under the Wong Lo Kat brand in red tin cans which eventually outsold Coca-Cola in China. Sales grew from 180 million yuan in 2002 to around 18 billion yuan last year, taking up 70 percent of the herbal drinks market.

GPC, which has sold Wong Lo Kat in less familiar green Tetra Paks, has largely been dwarfed, with a sales volume of 1.9 billion yuan in 2011, reported Xinhua News Agency.

However, JDB does not own the brand name, but only leased it from GPC in 1995. JDB was authorized to use the brand until 2010, but got the lease contract extended by bribing Li Yimin, a former GPC senior manager. The company discovered the fraud later and declared the extension void; Li was sentenced to a jail term of 15 years in 2005.

The dispute went to arbitration in April 2011, with the China International Economics and Trade Arbitration Commission ruling in May of this year that the brand rights rest with GPC.

"The ruling will hit JDB hard, as the company has invested heavily in Wong Lo Kat, which has grown into a brand worth over 100 billion yuan," Liu Hui, an industry analyst with Capital Securities, told the Global Times.

"The ruling is a heavy blow to JDB's years of efforts as well as to our consumers," commented Wang Yuegui, the company's brand manager, at a press conference in mid-May.

Yet Pang Zhenguo, JDB's branding chief, denied reports that the company would scale down, vowing instead to pump money into promoting the new brand.

JDB still owns the original formula and has announced it will continue to produce the drink "exactly the same as before" but sell it under a different name.

Meanwhile, GPC also claimed that it would "explore" the Wong Lo Kat trademark and apply the brand to a portfolio including herbal wine, cosmetics and other healthcare products. The corporation began recruiting 3,000 staff members on May 10 and set its sales target at 50 billion yuan annually by the end of 2015, according to a Xinhua report.

Huang Fusheng, principal food and beverage analyst at China Securities, predicted that it would be difficult for the pharmaceutical firm to replicate the success of JDB, while it would be equally tough for JDB to switch from Wong Lo Kat to its new brand.

"It is possible that some consumers will turn to the green-canned herbal tea produced by GPC in the short term," Liu Hui told Global Times, noting that given JDB's proven record in marketing and distribution, the company will still hold a significant market share even without the Wong Lo Kat brand.

Ni Yidong also admitted that GPC's main business focus is on the pharmaceutical sector and "lacks expertise in the consumer goods area."

"Long ago, Wong Lo Kat was no more than an herbal tea recipe and a brand of traditional medical products in decline. It used to be a 'chicken rib' that GPC held for years. But JDB was discerning enough to see its potential and made it the biggest herbal tea brand in China," Cai Enze, a well-known Chinese financial blogger, told China Daily.

Public affection for Wong Lo Kat was also inspired by JDB when it donated 100 million yuan on behalf of the brand to quake-hit Sichuan Province in 2008. That benevolent act was also a canny bit of promotion, commented Cao Yang, deputy director of the Intellectual Property Research Center at Shanghai University of Political Science and Law.

But the whole case is "like two kids scrambling for a toy. In the end the toy will be broken and the kids will be sad," Xinhua quoted a netizen as saying on Sina Weibo, the Chinese version of Twitter.

Such trademark spats may cool consumer ardor, Hong Tao, an analyst at the Beijing Technology and Business University, told the Straits Times.

"They won't know which brand to be loyal to," he said.

More competition will now be seen in prices, sales channels, brand building and market segmentation in the herbal tea sector, Liang Mingxuan, food researcher at CI Consulting, said to Xinhua.

Other big herbal tea companies, including Heqizheng and Denglao, are likely to bid for market share at this time of uncertainty, while second- and third-tier brands may be knocked out of the market, Liang added.

Copyright ©1999-2011 Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.