(Ecns.cn)--Five years ago, Miss Dong charged 191.11 yuan to a credit card, but forgot to pay it off. That mistake has resulted in an accumulation of interest and late fees adding up to 10,854 yuan (US$1,724), which the bank is now trying to claim, reports China Newsweek.

Dong was only a freshman in college when she was first urged by her school to apply for a credit card. She seldom used it, however, and almost left it behind completely after graduating in March of this year--that is until the bank tracked her down and told her to pay up.

Shocked by the unexpected debt, Dong pointed out that she had not received any notices from the bank during the past half-decade. Yet according to the bank, many letters had in fact been sent to Miss Dong, though they may not have reached her because of a wrong address.

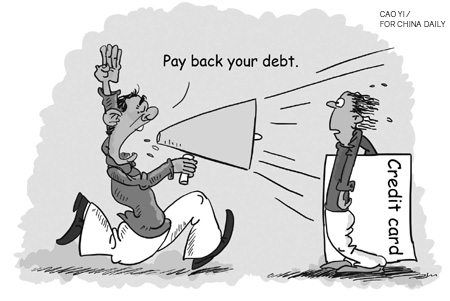

The two sides are currently trying to find a solution that will satisfy both parties, yet Dong's story is only one of many in the world of China's "credit card slaves."

Statistics show that since 1985, when Bank of China issued the first credit card, the availability of credit has rapidly expanded (especially during the last decade, when the country's middle class grew, living standards rose and the government encouraged the use of cards to stimulate domestic consumption).

By the third quarter of last year, China's banks had issued 286 million credit cards. About a third of credit card payments, or 1.1 trillion yuan, was generated from consumption spending in 2008. Credit cards accounted for almost 15 percent of retail sales of consumer goods, up sharply from 4.8 percent in 2006.

"Using credit cards will certainly help boost consumption, because at least some people won't perceive credit card purchases as affecting their bank balances," Joe Lu, an analyst at Bocom International in Beijing, told Reuters.

However, as the population of credit card holders increases, the number of defaults on repayment has also been growing.

"In the past two years, banks have blindly issued credit cards. The bubble has started to form, and the risks rooted in falsified application information and low-income customers are beginning to emerge," Nie Junfeng, an expert on personal debt at CITIC Bank, told Reuters.

College students are a major demographic for banks issuing credit cards, since it's not easy for young people to resist the instant gratification credit cards offer, analyzed the Global Times.

"Paying with a card makes me feel like I'm getting something for free," Feng Liwen, a senior at Zhengzhou University of Light Industry, told the newspaper.

"Whenever I go back home, I use a credit card to buy plane tickets, because at the end of the semester I'm usually short on cash," added Sun Chenghao, a senior student at the China Foreign Affairs University.

But such convenience also has its drawbacks. Of all the credit card debt cases heard by the People's Court in Beijing's Xuanwu District in July 2009, about 25 percent involved college students, said the Global Times.

That same year, the People's Bank of China revealed that credit card payments totaling 4.97 billion yuan were at least 60 days late in the first six months, a jump of 133.1 percent from a year earlier.

China Daily cited a blue book on the credit card industry issued by the China Banking Association in 2009, which showed that non-performing credit card debts increased considerably from 2008.

To tackle the bad debt, the Chinese government began scaling back a credit card policy that went too far and too fast in a country with little experience in personal debt.

The CITIC Bank suspended its college student card in February. Soon after, China Merchants Bank also halted its credit card designed for college students.

The China Banking Regulatory Commission told banks in July of 2009 not to offer gifts to new credit card holders, set quotas for their sales staff or issue cards to people younger than 18 (unless their parents had access to their accounts).

The Industrial and Commercial Bank of China, the country's largest commercial bank, now only gives credit cards to graduate students, as well as undergraduates studying at renowned universities who are expected to find well-paying jobs after graduation.

Several banks have also set up special collection teams for bad loans. They once called debtors or sent reminder text messages, but now they go directly to their homes, said Reuters.

As for those students who have grown accustomed to life with credit, while some have their complaints, most are understanding of the new policy, pointed out the Global Times.

"It is a little inconvenient, but for students like me who don't have an income and lack self-control, it's probably not a bad idea," Liu Yu, a student at Shanghai Jiaotong University, told the newspaper.

However, Zhao Xijun, a professor at Renmin University of China's School of Finance, offered a different perspective.

"It's better to teach students how to manage their finances when they actually have their own credit cards rather than deny them one," Zhao said.

Copyright ©1999-2011 Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.