In January this year, Star River Group, a developer specializing in luxury residential properties, claimed to enter the liquor industry.

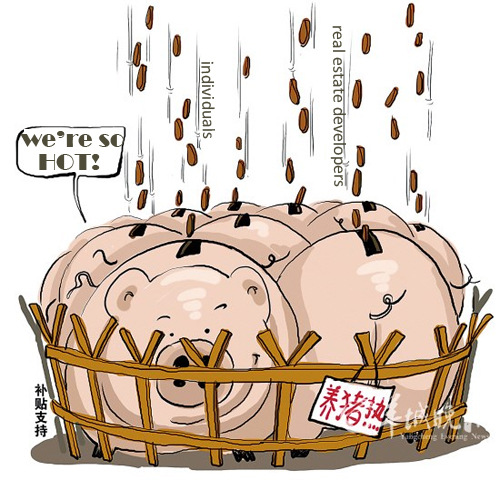

Some real estate developers are joining professional pig farmers in the profitable pig-raising industry.

(Ecns.cn)--China's real estate market is experiencing a serious downturn, with deals in the last three months hitting a record low despite home prices dropping significantly. As a result, investors are shifting their focus to other more profitable industries such as mining, retailing and e-commerce to survive the cold winter.

Home prices last December posted their worst performance, with only two of the 70 cities tracked posting gains. Prices in 52 of 70 cities monitored by the government declined from the previous month. New home prices in the nation's four major cities of Shanghai, Beijing, Shenzhen and Guangzhou declined for a third month, Bloomberg quoted the National Bureau of Statistics (NBS).

January this year witnessed a continuous fall as the government remains determined to stabilize the market. The NBS revealed that 48 cities out of a statistical pool of 70 major cities saw declines in new home prices, while none reported increases.

Consequently, the falling prices and sales volumes have been taking their toll on brokerages and real estate firms all across China. Although small brokerages with fewer than 50 branch offices have been hardest hit by the slumping property market, established players like Century 21, Centaline and Geland have all closed several of their offices this year, reported the Business Insider, a U.S. business and entertainment news website.

Zhou Jiancheng, head of the Enterprises Research Center at the E-house China R&D Institute, told the Southern Weekend that after taking a survey of 132 listed real estate companies, one-sixth of them have already or are planning to set foot into energy industries such as mining.

The China Poly Group Corporation, a top property developer, has started price-off promotions in over 40 cities this year, which resulted in a mere 1.5 billion-yuan in revenue in January, 70 percent less than the same period last year.

"The price cannot be further lowered," a manager from the company told the Southern Weekend.

Zhejiang-based Guangsha Holdings, one of the country's largest construction enterprises, invested 12 billion yuan in a petroleum project in Zhoushan, Zhejiang Province, at the end of 2011, becoming the first private enterprise involved in oil transportation and storage.

Lou Zhongfu, founder of the company, has stressed many times that energy would be their main business focus in the future.

The Country Garden, one of China's leading integrated property developers, also set up an investment company in Xilin Gol League, Inner Mongolia, last year to mainly mine local coal.

"The property businesses are getting tougher and tougher. Many of my friends who are developers have now shifted their attention to private equity investments, lending and oil extraction," Xiang Chengjin, general manager of the Inner Mongolia-based Jiacheng Property Consulting Co. Ltd, told the Southern Weekend.

In January this year, Star River Group, a developer specializing in luxury residential properties, claimed to enter the liquor industry.

The company launched spirits under its own brand in late January, aiming to achieve a sales volume of 60 billion yuan in several years.

The spirits cost about 20,000 yuan per kilo and is considered a pillar product, Liang Shangyan, vice president of Star River Group, noted.

Wang Jianlin, board chairman of Wanda Commercial Properties Co. Ltd., told the public in February that businesses related to cultural and tourism industries will be their core interests.

By 2011, the company had developed 49 plazas, 26 five-star hotels, 730 theaters, 40 shopping malls, and 45 karaoke bars across China, taking a leading role in the hotel, tourism, film and retail sectors.

Most investors and market watchers see the new downturn as a direct result of policies introduced by the Chinese government earlier this year aimed at cooling down the country's overheated property sector after years of runaway pricing, especially in affluent coastal cities.

As the central government recently reiterated its support for restrictions on the real estate market, many experts are wondering whether the country is heading towards the kind of dramatic bubble-bursting scenario that China bears have been predicting for years.

Yet a report by Fortune Magazine last month pointed out that China's housing prices will slide during what's expected to be a rocky economic year, but the market won't crash.

In 2010, a total of 4.4 trillion yuan of residential buildings were sold in China. However, mortgage loans outstanding were far less, at 1.4 trillion yuan, the magazine cited a JP Morgan report on China's housing market from November 2011.

"As a result, the probability of mortgage default is quite low," analysts say, adding that the quality of mortgage loans will "remain solid" even under the hypothetical scenario that home prices drop by 30 percent.

Moreover, as incomes rise and as more of the country's population is expected to move into urban areas (in January, China's urban population surpassed that of its rural areas for the first time in the country's history), demand for housing is expected to remain robust, Shaun Rein, managing director of China Market Research Group, a Shanghai-based market research firm, told Fortune.

The declines are part of the government's plans to cool down its hot real estate market, making it more affordable for more Chinese to buy property, Fortune analyzed.

According to JP Morgan, over the next year and a half, prices could fall 5-10 percent at the national level. At the regional level, where prices have risen much more rapidly (it notes prices surged an average of 82 percent between 2007 and 2010 in 35 major cities), prices are expected to fall by 20 percent.

"This will likely slow the pace of economic growth but not lead to a hard landing," said a JP Morgan's analyst.

Copyright ©1999-2011 Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.