(Ecns.cn) –Every investment boom attracts a large number of wealthy people and profit-seeking speculators, but in the case of China's growing domestic art market, Chinese enterprises have changed the rules of the game, making it increasingly difficult for many private investors to compete at all.

Compared to the art-buying explosion between 2007 and 2008, the booms and busts at art exchanges and auctions began to change after 2010, as the pockets of enterprises and public collections grew deeper and their intentions more forceful.

By applying the logic of "money talks," the substantial capital from corporate sources is gradually reshaping the Chinese art market from individually-based to one that is more institutionally-based, experts say.

Scrambling for art and cultural relics

Last year, global art auction sales surged to a record $11.5 billion despite the weak world economy, with China cementing its spot as the top market, according to research published on Wednesday.

Turnover at China Guardian Auction Co. and Poly International Auction Co., the country's two largest auction houses, soared to 11.23 billion yuan and 12.1 billion yuan in 2011, representing a year-on-year rise of 49 percent and 20 percent respectively, said Xinhua News Agency.

In an almost frantic demand, art prices have soared over the past three years, ousting many traditional collectors and individual investors from the market for world-class works, according to China Economic Weekly.

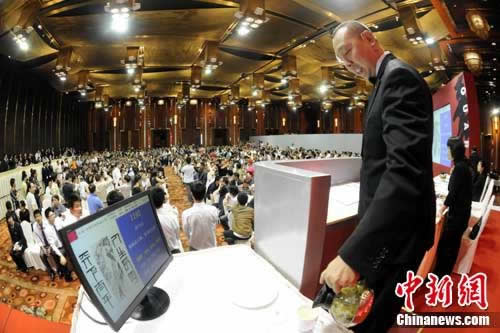

On the evening of May 22, 2011, Guo Guangming, a private collector in Beijing, arrived very early at the China Guardian 2011 Spring Auctions, hoping to get a front-row seat.

According to Guo, the auction displayed 32 masterpieces from both ancient and modern times, each of which had an average assessed value of between 10 billion yuan (US$1.59 billion) and 100 billion yuan (US$15.9 billion).

Many mysterious buyers were also present that day, added Guo, and they all displayed powerful financial backgrounds.

After a few rounds of bidding, Guo realized he wouldn't be able to afford anything, but refused to leave because he wanted lay eyes on a Qi Baishi masterpiece he had longed for.

That work, entitled "Eagle Standing on Pine Tree with Four-character Couplet in Seal Script," is said to be Qi's largest, and consists of a painting measuring 266 cm by 100 cm and a pair of calligraphy scrolls each measuring 264.5 cm by 65.8 cm.

The starting price for the piece was 88 million yuan (US$14 million), which quickly shot up to 100 million yuan (US$15.9 million) after the first offer. It eventually sold for 425.5 million yuan (US$67.6 million).

Later, there were rumors that Qi's work might've been bought by Hunan TV & Broadcast Intermediary Co., which has been very generous at art auctions in recent years.

According to its financial statements, the company has already bought more than 160 works by renowned artists such as Qi Baishi, Xu Beihong, Fu Baoshi, Li Keran, Zhang Daqian and Wu Changshuo. In 2010, it registered another company to focus mainly on art investment, on a scale worth about 306 million yuan (US$48.6 million).

Investors should use caution

Between 2007 and 2008, about 40 percent of auction turnover came from enterprises, but the rate had already risen to more than 70 percent in 2011, according to China Economic Weekly.

Whether to build the reputation of an enterprise or strengthen the corporate image, the country's turbulent stock market and a cooling real-estate sector may be major reasons for the large amount of capital flowing into the art market.

Statistics show that the annual rate of return on art investments stood at around 26 percent over the past six years, outperforming rates in the stock market and housing sector, both of which come with large risks, according to Xinhua.

However, investors should acquire a solid knowledge base of both the art market and the financial market before plunging in, experts say.

Copyright ©1999-2011 Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.